Gift Planning

Gifts from Retirement Plans During Life

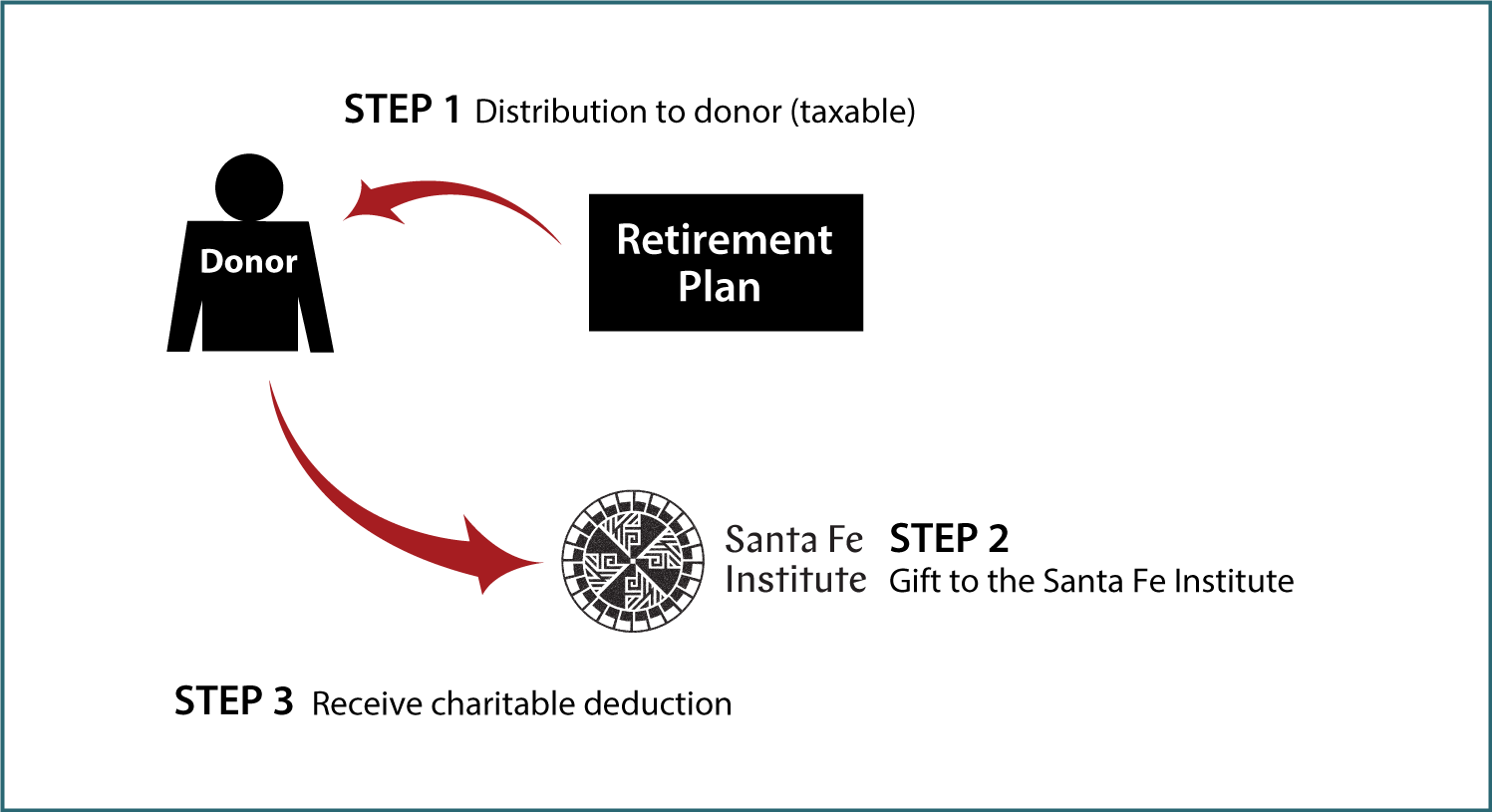

How It Works

- You take a distribution from your qualified retirement plan or IRA that is includable in your gross income

- You make a gift of the distribution or of other assets equal in value to the distribution

- You receive an offsetting charitable deduction

- If you are 70½ or older, read ahead about the IRA rollover opportunity available to you

Benefits

- You may draw on perhaps your largest source of assets to support the programs that are important to you at SFI

- The distribution offsets your minimum required distribution

- If you use appreciated securities instead of cash from your distribution to make your gift, you'll avoid the capital-gain tax on the appreciation

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

If you have any additional questions or would like to discuss the specifics of your planned gift, please contact Denise Wernly at 505-946-2720 or email her at dwernly@santafe.edu. |

Santa Fe Institute |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer