Gift Planning

Closely Held Business Stock

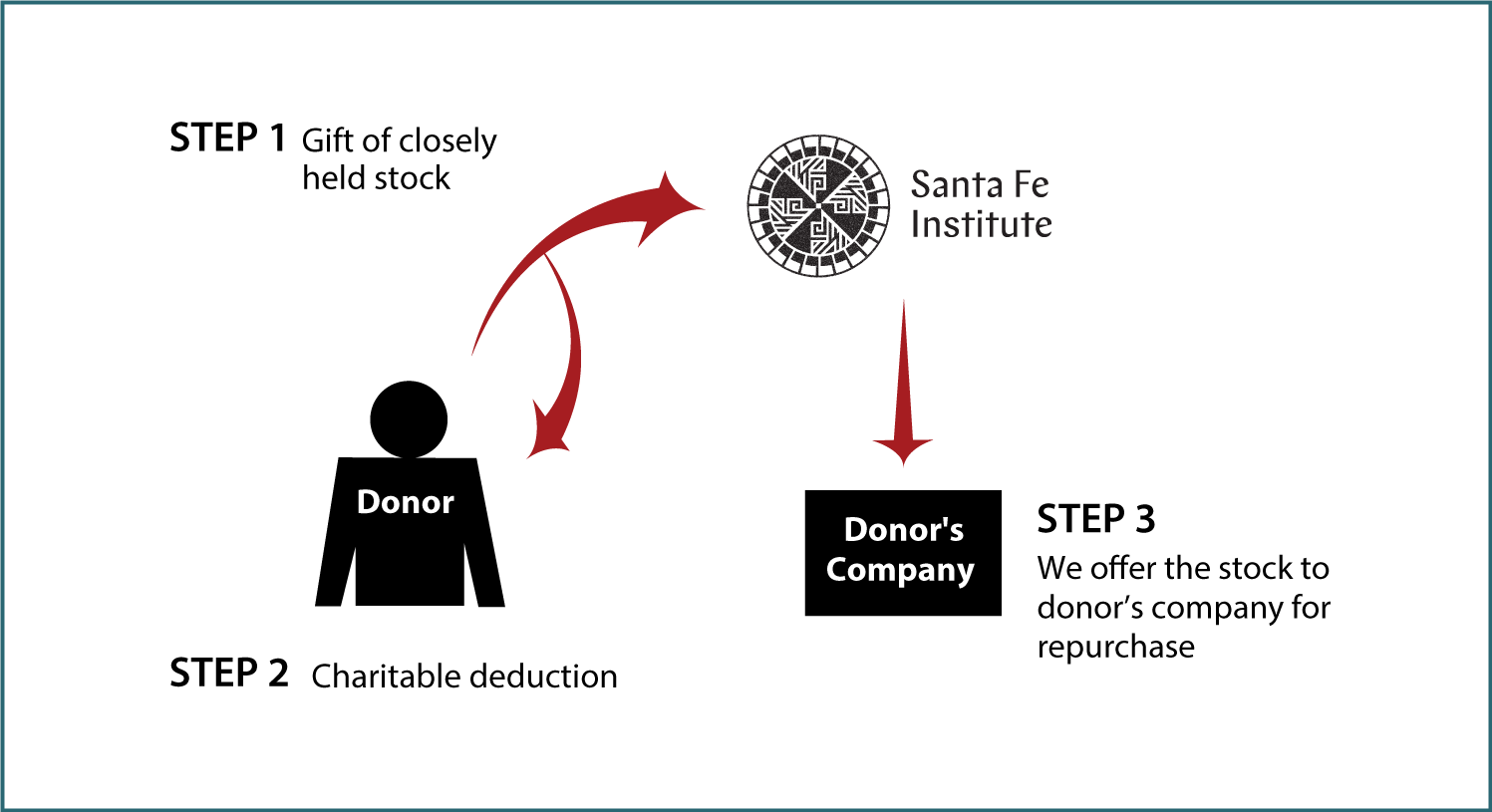

How It Works

- You make a gift of your closely held stock to SFI and get a qualified appraisal to determine its value

- You receive a charitable income-tax deduction for the full fair-market value of the stock

- SFI may keep the stock or offer to sell it back to your company

Benefits

- You receive an income-tax deduction for the fair-market value of stock

- You pay no capital-gain tax on any appreciation

- Your company may repurchase the stock, thereby keeping your ownership interest intact

- SFI receives a significant gift

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

If you have any additional questions or would like to discuss the specifics of your planned gift, please contact Denise Wernly at 505-946-2720 or email her at dwernly@santafe.edu. |

Santa Fe Institute |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer